Auto collision insurance is a type of insurance policy designed to cover the cost of repairing or replacing your vehicle in the event it is damaged in a collision. Whether you’re involved in an accident with another car, a tree, a telephone pole, or any other object, auto collision insurance can help you get back on the road again without having to worry about costly repair bills. Let’s take a closer look at how auto collision coverage works and why it’s so important.

What Does Auto Collision Insurance Cover?

Auto collision coverage will typically cover not only the cost of repairing your vehicle but also any medical bills that result from injuries sustained during an accident. In some cases, you may even be able to file a claim for lost wages if you were unable to work due to the accident. Depending on your state laws and the terms of your policy, auto collision coverage may also provide rental car reimbursement while your vehicle is being repaired or replaced.

How Much Does Auto Collision Coverage Cost?

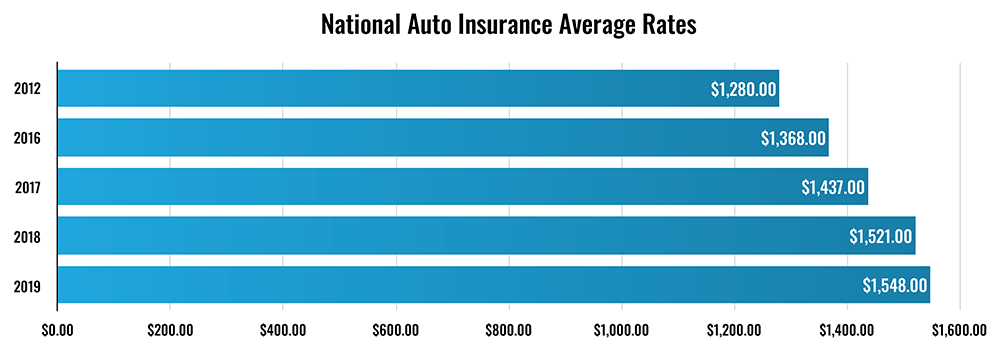

The cost of auto collision coverage varies depending on several factors such as the make and model of your car, where you live, and how much coverage you want. Generally speaking, however, the national average for car insurance is $1,771 per year for full coverage, which amounts to $148 monthly. That might sound like a lot of money—but it’s nothing compared to what you would have to pay out-of-pocket if you were involved in an accident without any form of insurance.

How do I save money on auto insurance?

The number one tip is to see what is out there and take the time to compare rates and go over the policy with your agent. It is good to note that just because an insurance company is offering the lowest price, they may not be the best option. A lot of factors such as customer service, part restrictions, and vehicle rentals can play a role in your decision-making. Also, customers should be conscious that every claim made using their insurance can cause it to increase, even something as simple as a window replacement. Sometimes, it may be worth it to pay for vehicle damage out of pocket to avoid paying an overall increase for your auto insurance policy that will cost more over time.

Do I Really Need Auto Collision Coverage?

In the United States, it is illegal to drive in any state without being able to present financial responsibility for damages or liability if you were to experience an accident. Auto insurance represents this financial responsibility in most states. If you could afford to replace or repair your vehicle without taking out a loan, then depending on your state, auto collision coverage may not be necessary for you. However, if there’s even the slightest chance that an accident could leave you financially crippled for years afterward—it’s probably best to invest in some form of protection just in case.

No one ever wants to think about getting into an accident—but unfortunately, it happens every day all over the world. While no amount of insurance can protect against bad luck or prevent accidents from happening altogether; having access to quality auto collision coverage can at least give drivers peace of mind knowing that they won’t have to face massive repair bills alone if something does happen down the road. A Start2Finish support agent can help answer questions you may have regarding your policy and repair. The moral of the story is, for those who own vehicles—auto collision insurance is essential!